Invest in T-Bills

T-Bills are a safe and reliable investment option for individuals looking to grow their savings with minimal risk.

What is T-Bills? Opportunities

Treasury Bills (T-Bills) are short-term financial instruments issued by the Government of India, aimed at meeting immediate funding needs, with repayment guaranteed on a specified date.

Regarded as one of India's top fixed-income investments, T-Bills are zero-coupon securities sold at a discount to their face value, with the full-face value repaid on the maturity date.

T-Bills, government-backed short-term debt instruments are available in tenures of 91, 182, or 364 days. With Innovators Hub, you can conveniently purchase T-Bills, which are then allocated to your demat account.

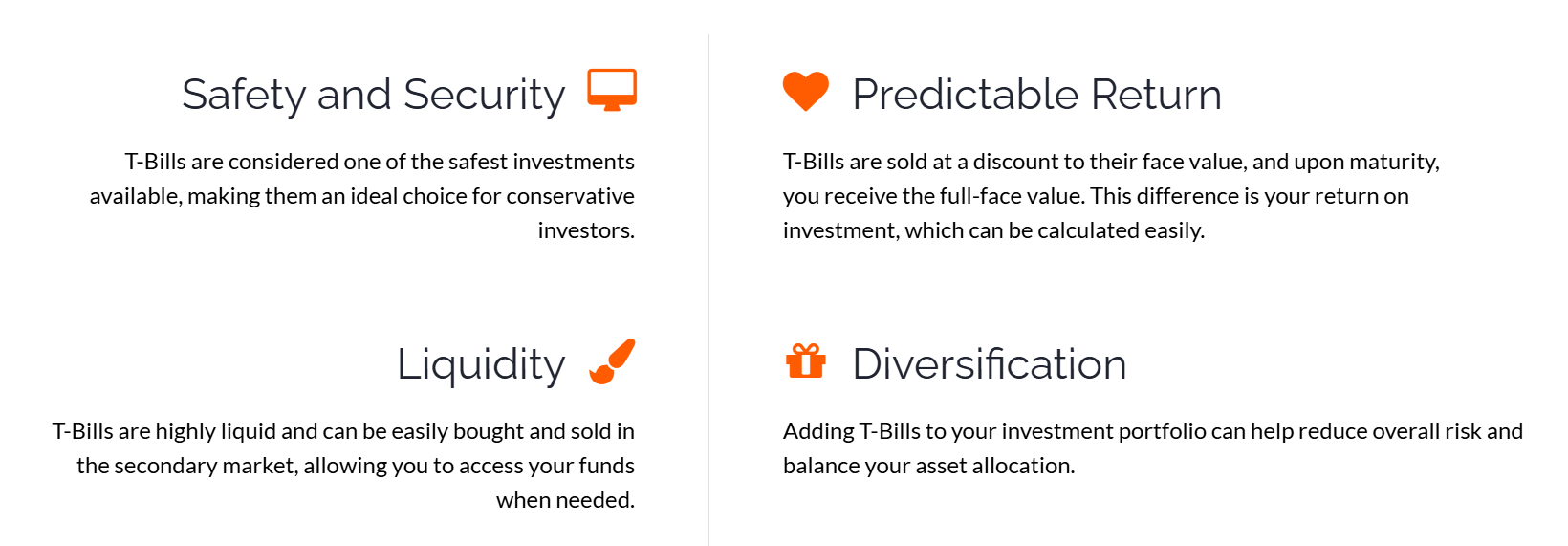

Why invest in T-Bills?